Whole Turnover Insurance

Trade with Confidence

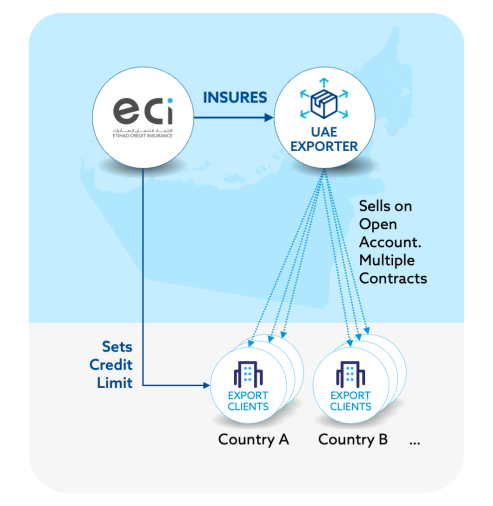

Etihad Credit Insurance (ECI)'s Whole Turnover Insurance insures your business against non-payment of invoices due to commercial default or non-payment due to political risk. From small businesses to large enterprises, with ECI's Whole Turnover Insurance, we’ve got you covered every step of the way.

Who is it for?

Perfect solution for exporters, big and small, who are working with multiple clients across the world and want to substantially reduce their business risk from non-payment risks

Allows you to grow and expand your business to new markets with confidence by transferring your risk of non-payments to ECI.

A good fit for businesses that are looking to enhance their internal credit management policy.

Key Benefits

Secure your business transactions by transferring credit risk to the insurer, enabling smoother operations

Improve your competitiveness by offering credit terms while limiting potential risks.

Protect your balance sheet against structural losses that might impact your net worth or overall business results.

Product Features at a Glance

How It Works

Step-by-step Guide

Collaboratively agree on the insurance terms and conditions with ECI and sign the policy.

Decide on the maximum outstanding (Risk Exposure) for each client and apply for a credit limit.

ECI assesses each client’s credit worthiness and sets a limit, which is the maximum outstanding insured.

You trade with confidence knowing you’re protected.

Remember, this is a simplified guide, and each step can be tailored to suit the unique requirements of your business operations. Your financial security is our priority.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

If your client does not pay within the agreed payment terms, you inform ECI. We will assist you with debt collection and loss minimization.

If you’ve exhausted all recovery efforts, submit a claim online, along with evidence of loss and policy compliance.

Once your documentation is complete, ECI assesses the claim diligently, ensuring transparency and adherence to policy conditions.

After the claim assessment, ECI will send the payout calculation details for your approval. Once signed off, the claim is paid out promptly.

ECI, together with the bank, continues efforts to collect the outstanding as long as there's a potential for recovery.

Even after the claim payout, we’ll continue the recovery process in collaboration with you if there are potential recoveries available.

Go ahead and explore new horizons with the confidence you need to grow.

With ECI Whole Turnover Insurance, you can offer credit terms to clients with ease, and get an advantage over the competition. By limiting your risks, you gain an advantage over other vendors who require advance payment or Letters of Credit (LOCs).

You may be exporting or re-exporting goods and operating on thin margins with large volumes to support your business model. Even a single payment default can disrupt your cash flow and impede your Business sustainability. ECI Whole Turnover Insurance allows you to build your bottom line by limiting your risk exposure thanks to its limited cost.

Our Whole Turnover Insurance allows you to cover the costs of structural losses against your profit margin. This keeps your balance sheet healthy and increases the net worth of your business.

Being insured will put your company in a better position once you will approach your bank for a working capital facility. The bank will feel more confident in accepting to finance your business because they know that your receivables are already insured by an AA- rated company.

The whole Turnover policy includes : a monitoring service. ECI will monitor the creditworthiness of your customers during the policy period and in case of Default , ECI will provide you the necessary support for the collection of your overdues.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!