Supply Chain Finance Insurance

Finance your imports with confidence.

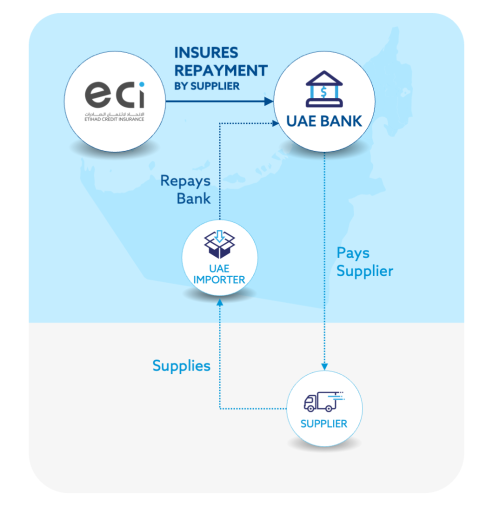

To support your business cash flow, you may need to finance import purchases. You do this by getting a bank loan that allows your bank to pay your supplier directly.

Etihad Credit Insurance (ECI)’s Supply Chain Finance Insurance secures your bank against the potential risk of default on payments for your loan. This makes lending to you an easy and smart decision for your bank.

Who is it for?

Whether you have a small business or a large enterprise, ECI can support your venture by insuring a bank loan that is used to finance your import supply chain. You need to import raw materials, other supplies, or services you may need to fulfill your export orders. Your bank can give you a loan that allows you extended payment terms while paying your supplier directly. ECI’s Supply Chain Finance Insurance makes it easy for your bank to give you a loan.

Key Benefits

Etihad Credit Insurance (ECI)’s Supply Chain Finance Insurance enables you to finance payments to your suppliers with a bank loan that lets your suppliers be paid on time so you can: • Negotiate discounts from your supplier for prompt payments • Have extended loan repayment terms • Get the supplies you need when you need them

Credit insurance reduces your risk perception by your lending institution or bank. Instead of being perceived as an unknown, your bank feels secure that their loan to you is insured by a AA- rated organization.

Your bank will be able to file a claim in the case that you default on your loan. The claim is usually paid out before any other collateral is activated.

Etihad Credit Insurance (ECI)’s Supply Chain Finance Insurance acts as additional collateral against your bank loan. Its value is transparent and it can be realized at short notice.

Etihad Credit Insurance (ECI)'s Supply Chain Finance Insurance is AA- rated. This enables your bank to significantly reduce the amount of capital required.

Product Features at a Glance

How It Works

Step-by-step Guide

The bank will provide ECI with all information about the loan that is to be insured for you.

ECI will prepare an initial quote based on the information provided. It will include an overview of additional information needed for a thorough assessment and binding proposal.

ECI will work with the bank to discuss details of the coverage, wording for policy agreement, risk management, and commercial disputes, and conduct a thorough assessment of the risks including management of commercial disputes.

Once the internal and external approvals are in place, the policy is signed off by the bank and activated. Now your supplier can be paid by the bank.

ECI will only get involved in the case of a payment default or indications of potential payment problems. You are free to move ahead with your supplier with confidence.

Remember, this is a simplified guide. Each step can be tailored to suit the unique requirements of your business operations. Your financial security is our priority.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

The bank will inform ECI as soon as it is aware that there may be a payment problem. Notification is mandatory 30 days after the due date for a scheduled loan repayment. ECI will work with you and the bank to resolve payment delays amicably, ask for assistance from a specialized agency, or initiate formal litigation.

If all recovery efforts are exhausted, the bank will submit a claim along with all evidence of loss and policy compliance.

ECI will assess the claim diligently, ensuring transparence and adherence to the policy. Claim assessment may take up to one month.

After the claim assessment, ECI will send out the payment calculations to the bank for its approval. Once signed off, the claim is promptly paid out.

As long as the potential for recovery remains, ECI will continue recovery efforts together with the bank even after a claim is paid out. Any recoveries will be shared between the bank and ECI as per the policy agreement.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!