Single Risk Insurance

Export with Confidence

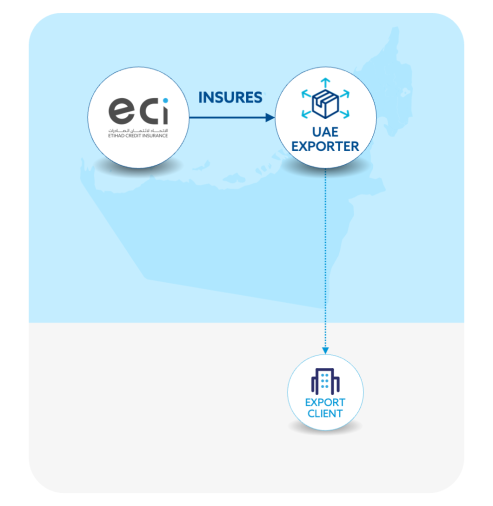

Etihad Credit Insurance (ECI)’s Single Risk Insurance mitigates your risk against non-payment for a specific transaction or a specific project. The coverage insurance can be for a single transaction, or multiple contracts with the same client.

Who is it for?

ECI’s Single Risk Insurance is available to exporters big and small. Whether you are working with a specific client with larger volumes or if a single client makes up a large proportion of your export turnover, Single Risk Insurance is a good solution to minimize your risk of non-payment.

Our Single Risk Insurance allows you to test the waters with a new client with ease and confidence by transferring your risk to ECI.

Key Benefits

When working with new clients or unfamiliar territories, ECI’s Single Risk Insurance can protect your business from unexpected losses on large contracts or transactions.

Insure your receivables from a new client and protect your business from non-payment due to bankruptcy, commercial default, or other factors.

If you are using your contract or order as collateral for a loan to complete the order, your bank may require you to mitigate risk by insuring your contract. We can provide the insurance you need to conduct your business hassle-free.

Product Features at a Glance

How It Works

Step-by-step Guide

Share as many details as you can about the client, contract, or transaction/s you want to insure with your ECI representative. We will prepare an initial quotation based on your requirements.

Collaboratively agree on the insurance terms and conditions.

Once the general terms and conditions are approved by you, we will follow up with a thorough assessment and provide you with a firm and detailed quote. The policy is finalized after you approve all details.

After the policy is signed and finalized, you may trade with your client worry-free. ECI will only get involved in case there is a default in payment for the insured client or contract.

Remember, this is a simplified guide. Each step can be tailored to suit the unique requirements of your business operations. Your financial security is our priority.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

Notify your ECI representative as soon as you are aware that there could be a payment problem. This includes commercial disputes or any political activity that can indirectly affect the payment. Your policy will also mention when you should report any payment delays.

Together with you, we will work on the best way to manage any potential payment problems. We will assess the situation and try to resolve the payment delays amicably, request assistance from a specialized agency, or we can initiate a formal lawsuit.

Once it has been determined that not all your receivables can be recovered, you can submit a claim online along with evidence of loss and policy compliance. In case you need assistance with this process, your ECI representative will help you complete the required documentation.

After you have submitted your claim online, ECI will assess the claim diligently, ensuring transparency and adherence to policy conditions. Claim assessments may take up to one month after all the documentation has been submitted.

Once the claim has been assessed, ECI will send you details of the calculation for your approval. Following your approval, the claim will be promptly paid out to you.

If potential recoveries are possible, ECI will work with you to continue the recovery process even after the claim payout.

ECI’s Single Risk Insurance offers longer-term policies of up to 5 years so you can export with confidence by transferring your risk of non-payment due to commercial or political activity to ECI.

Your internal credit and risk management rules may not be sufficient to take on individual contracts, counter-parties, or countries. ECI’s Single Risk Insurance can bring your credit risk to an acceptable level.

Our Single Risk Insurance allows you to operate with the security you need in developing regions or nations that may have low foreign currency reserves. Single Risk Insurance protects you and your business in case your client or their bank is unable to proceed with payment.

Our team will thoroughly assess your new client’s financial capabilities, reputation, and governance so you can grow with confidence.

At times, a client may unilaterally decide to cancel a contract or order already in process. ECI’s Single Risk Insurance allows you to trade in the marketplace free from worries about contracts that are canceled at the last minute.

Formal litigation can be cumbersome, take years to litigate, and divest energy and resources from your business with no guarantee of success. Your ECI Single Risk Insurance policy provides easy, simple, and transparent protection against payment default by a client.

Your Single Risk Insurance policy gives you access to our team of experienced and knowledgeable representatives, who can help you assess new clients and territories, as well as expedite any payment default recoveries.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!