Project Finance Insurance

Lend with confidence to get paid.

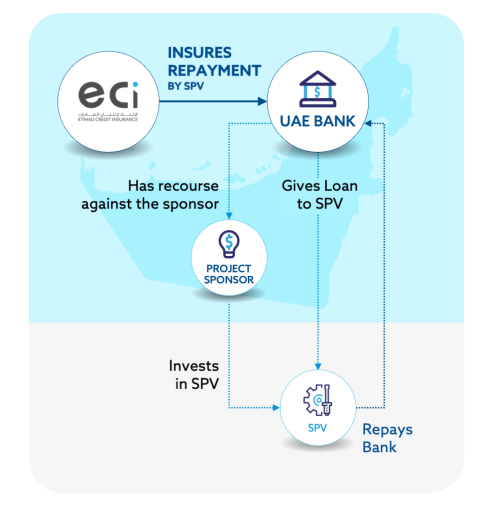

Etihad Credit Insurance (ECI)’s Project Finance Insurance protects UAE banks in case of payment default on a loan granted to an SPV backed by a UAE company.

Loaning to Special Purpose Vehicles (SPVs) comes with a higher risk because it must repay a bank loan with the cash flow it generates, without additional support from its shareholders. ECI insures the credit risk for the entire duration of the loan.

Who is it for?

UAE banks that give loans to SPVs and are sponsored by at least one UAE business or company.

Key Benefits

The level of non-performing loans is much higher in project finance than in traditional corporate banking. ECI’s Project Finance Insurance mitigates the risk of non-payment by SPVs and lets UAE sponsors invest with confidence in the project.

In case of payment default, ECI’s Project Finance Insurance can be claimed and is usually paid out before other collateral can be activated.

Overseas projects can be associated with unanticipated political risks that can be difficult to manage. ECI’s Project Finance Insurance can minimize the risk of loss from loan payment defaults by SPVs due to a broad range of global scenarios.

When you sign on for Project Finance Insurance, you gain access to ECI’s team of experts in the UAE and our overseas resources to assess risk, complete required documentation by the borrower, and other mitigation measures. ECI is a trusted partner in providing support to SPV projects.

ECI’s AA- rated insurance significantly reduces the bank capital required to allocate to an asset. Banks appreciate this support and assistance.

Product Features at a Glance

How It Works

Step-by-step Guide

The lending bank will contact ECI with general information about the loan it wants to insure. Loans that have already been disbursed are not eligible for insurance.

Once it is determined that the loan can be insured, ECI will prepare an initial, non-binding quotation. Also included will be an overview of the information needed for ECI to make a thorough assessment and provide a binding proposal.

ECI will complete a thorough assessment of the project including the critical standalone parts of the project as well as contextual information specific to the country where the project will be located. ECI will indicate several conditions before the policy is effective. These include, but are not limited to: financial viability, government relationships, IFC performance standards, Equator Principles, KYC, Anti Money Laundering, environmental and social impact, involvement of politically exposed persons, and more.

Once internal and external approvals are given for the terms and conditions and the bank signs the policy, the loan can be disbursed. ECI will only be involved in case of payment default or indications of payment problems.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

The bank will notify ECI as soon as it becomes aware that there may be a potential payment problem. Notification is mandatory 30 days after default on the scheduled due date.

ECI will work together with the bank to agree on the best way to manage recovery. Amicable resolution of payment delays, assistance from a specialized agency, or initiating formal litigation may be used to recover payment.

Once it is determined that not all payments can be recovered, the bank can submit a claim along with evidence of loss and policy compliance.

ECI will assess the claim diligently ensuring transparency and adherence to policy. The claim assessment can take up to one month.

After the assessment is complete, ECI will send details of the calculation for approval and sign-off. The claim will be promptly paid out.

If there are still chances of potential recoveries, ECI will work in collaboration with the bank for additional recovery efforts. Any recoveries will be shared between the bank and ECI as per the policy agreement.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!