Pre-Shipment Risk Insurance

Produce with Confidence to Get Paid.

As an exporter who makes custom-made goods for your clients, you make a significant investment in materials and labor to produce client orders.

You need to cover your investment and order because the goods you make are uniquely valuable to your buyer. Your order may have little or no other market value.

For example:

- Merchandise with logos;

- Custom-made furniture, garments, or other items;

- Bespoke luxury goods like cars, yachts, or other items;

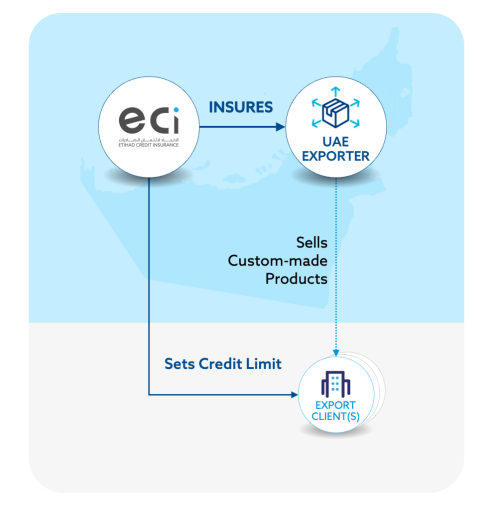

- Etihad Credit Insurance (ECI)’s Pre-Shipment Risk Insurance protects you from loss before delivery, in the case of an unexpected cancellation of your order.

Who is it for?

• Merchandising items with logos, like banners, t-shirts, and other printed materials. • Bespoke luxury goods like yachts, cars, furniture, kitchens, and custom-made garments.

Key Benefits

When you produce customized items like merchandise with logos or other custom goods for your client, they have no market value other than for your buyer. ECI’s Pre-Shipment Risk Insurance protects your business from loss due to cancellation of the order.

Pre-Shipment Risk Insurance minimizes your risk from loss in case of non-payment of Cash On Delivery (COD) or Letter of Credit (LOC) deliveries.

Protect your business against potential risks while working with new markets or clients, especially when a large transaction or order can significantly impact your bottom line. Pre-Shipment Insurance completes the post-shipment coverage you already have.

If you need a working capital loan to complete your order and use it as collateral for the loan, your bank may request that you mitigate the risk of your order. ECI’s Pre-Shipment Risk Insurance will meet your bank’s requirements.

ECI’s Pre-Shipment Insurance gives you access to our expertise, knowledge, and resources. We can thoroughly investigate and assess your potential client’s financial capabilities, reputation, and governance. ECI is your partner to help you grow with confidence.

Initiating a formal lawsuit to recover your costs from loss can be cumbersome, expensive, and take many years for an outcome, all without the guarantee of success. With ECI’s Pre-Shipment Insurance, you know exactly when you can file a claim and when it will be paid.

Product Features at a Glance

How It Works

Step-by-step Guide

Provide ECI with all the information you have about the contract you want to insure. ECI will use this information to confirm the contract can be insured. The more information you provide, the faster ECI can make an effective assessment. Contracts that have already been signed are not eligible for insurance.

Once ECI has confirmed that the contract can be insured, we will submit a tentative quotation for your review. It will include an overview of the information needed to make a thorough assessment and prepare a final policy proposal.

At this stage, ECI will perform a thorough assessment for the specified contract to be insured. Your ECI representative will work with you to discuss details of the risks covered and help you gather any additional information that may be required.

After the assessment is completed and terms are mutually agreed upon, the policy is signed and your contract is insured. If your bank is using the insurance as collateral, it may be actively involved in discussions and policy wording before the policy can be signed.

Once your policy is signed and activated, you can produce with confidence to get paid. ECI will only be involved if there is a contract cancellation or if there are indications of potential delivery issues.

Remember, this is a simplified guide, and each step can be tailored to suit the unique requirements of your business operations. Your financial security is our priority.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

Notify ECI as soon as you become aware that there may be an issue that can affect delivery. This includes commercial disputes or any other events that can indirectly affect the contract and delivery.

If you’ve exhausted all recovery efforts, submit a claim online, along with evidence of loss and policy compliance. If you believe that further recoveries can be managed after the end of the waiting period, you can postpone the filing.

Once your documentation is complete, ECI assesses the claim diligently, ensuring transparency and adherence to policy conditions.

After the claim assessment, ECI will send you the details of the calculation for your approval. Once signed off, the claim is promptly paid out.

If there is still potential for recovery, ECI will work with you to maximize the chances of recovery. Any recoveries will be shared between you and ECI as per your policy agreement.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!