Political Risk Insurance

Protect your investment against political risks.

Etihad Credit Insurance (ECI)’s Political Risk Investment shields your investment overseas from loss due to a broad range of political events.

The insurance offers coverage against loss from:

- Confiscation, expropriation, or nationalization due to government action.

- War, civil war, or social disturbance that causes physical damage or prohibits access for a prolonged period.

- Currency inconvertibility.

- Currency transfer risk.

- Breach of contract or non-honoring of obligations by the host government.

- Embargo or international sanctions imposed on the country where the project is located.

Key Benefits

If your investment is for a long-term project that may be affected by several election cycles and changes of government, ECI’s Political Risk Insurance can offer protection for your investment.

Your project stakeholders and lenders may require political risk insurance to mitigate the risk of the project. ECI’s Political Risk Insurance can meet these requirements.

Product Features at a Glance

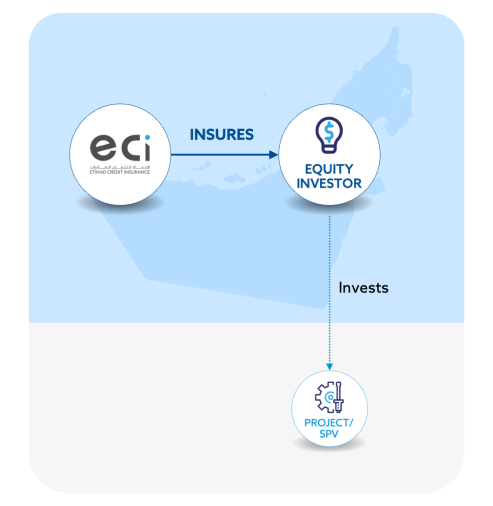

How It Works

Step-by-step Guide

Political Risk Insurance is typically considered after all other parts of the project have been finalized. Assessment criteria can include:

The financial viability of the project is assessed by considering all the elements that can affect the economic sustainability of the project. Investments that fail can prompt hostile reactions from the host government and communities impacted by the project. These may trigger insured events.

Commitments with governments and other public entities must be realistic and in accordance with best practice to avoid rejection by future governments.

ECI will assess that the project balances environmental and social impact to minimize risk

Due diligence, Know Your Customer (KYC), Anti Money Laundering (AML), and involvement of Politically Exposed Persons (PEP) should be in accordance with international standards for best practice.

The country profile of where the project will be located will be assessed based on its history and long-term trends.

ECI assesses all critical parts of the project, both stand-alone and in the context of the country where the project is located to determine risk. Assessment depends on the specificities of the particular project.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

The claim process requires adherence to the criteria outlined in your policy. Criteria for claim eligibility: - Compliance with the conditions and commitments stated by ECI at the inception of the policy will be monitored and must be adhered to as a condition for claim eligibility. - This includes environmental initiatives, support for local communities, employment of the local population, and other conditions in the country where the project is located. The timing for filing a claim and the duration of the waiting period before the claim is paid out depends on the insured risk or risks that initiated the claim.

In this case, the condition would be the inability to access the premises of the project for an uninterrupted period of 180 days.

In this case, the amount that is required to be transferred must be available in domestic currency in the local bank account.

A claim can be triggered by an arbitration award default. Your insurance contract may specify that the policyholder must initiate arbitration against the counterparty. The claim will be paid out if the policyholder wins the case (arbitration award) and the counterparty fails to respect the award.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!