LC Confirmation Insurance

Confirm Letters of Credit without risk.

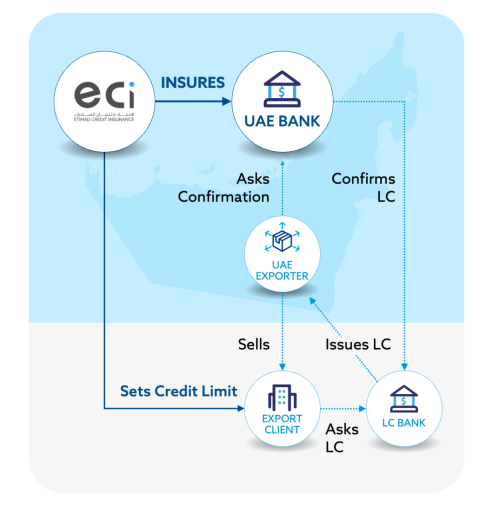

Etihad Credit Insurance (ECI)’s Letter of Credit (LoC) Insurance helps UAE banks provide exporters the service they need to trade with confidence.

As an exporter, you can secure payment for your goods or services through an LoC issued by your foreign buyer’s bank. The issuing bank may not have the credit rating you require. In this case, you will go to your UAE bank to confirm the LoC so that if the issuing bank fails to make payment, then your UAE bank will pay you instead.

However, this requires your UAE bank to take a higher risk because the issuing bank is unrated. Your bank can mitigate this risk by transferring it to Etihad Credit Insurance (ECI)’s, an AA- Fitch rated institution, with ECI’s LoC Confirmation Insurance.

ECI’s LoC Confirmation Insurance insures LoCs issued to you for your export goods in the case of default by the issuing bank.

Key Benefits

LoC confirmation is not a core business for banks. On the other hand, UAE exporters need this service to trade with confidence. ECI’s LoC Confirmation Insurance enables UAE banks to provide the service UAE exporters need with minimal risk.

The insurance premium paid to ECI leaves an acceptable profit margin for the bank on the insured portion of the LoC confirmation.

ECI’s LoC Confirmation Insurance allows UAE banks to transfer the risk of an LoC issued by an unrated foreign bank to ECI, an AA- Fitch rated institution. The insured part of the potential liability can secure capital relief for UAE banks.

ECI has knowledge and resources that can provide critical information about banks globally. ECI can provide reliable information at a better cost and with a quicker response time than UAE banks.

Product Features at a Glance

How It Works

Step-by-step Guide

The UAE bank will apply for a master insurance contract with ECI. The bank will provide ECI with details of the businesses it will cover, including the acquisition process and how exposure and potential loss are managed.

ECI will provide general information about countries covered, the application and claims process, pricing, premium payment, and general conditions of insurance.

Once the terms and conditions are agreed upon the policy will be issued.

The bank will apply for a credit limit for each LoC confirmation it wants to insure.

ECI will issue a credit decision. If the decision is positive, a certificate of insurance will be provided.

UAE exporters can trade with confidence and UAE banks can know they’re protected.

Remember, this is a simplified guide, and each step can be tailored to suit the unique requirements of your business operations. Your financial security is our priority.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

You will notify your UAE bank as soon as there is default in payment. You will provide all the information you have regarding the causes of the payment delay. The bank will notify ECI as soon as it receives notification from you and also contact the issuing bank to understand the cause of delay and potential recovery.

If there is no short-term solution available, the UAE bank will prepare full documentation including that you have met all your obligations, and submit it with the claim form.

ECI assesses the claim diligently, ensuring transparency and adherence to policy conditions.

ECI will promptly pay the insured portion according to the timelines set in the master insurance contract.

Together with the UAE bank, ECI will continue recovery efforts as long as there is potential for recovery. The insurance policy defines how expenses and recoveries are allocated to each party.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!