Invoice Discounting Insurance

Discount Your Receivables with Confidence

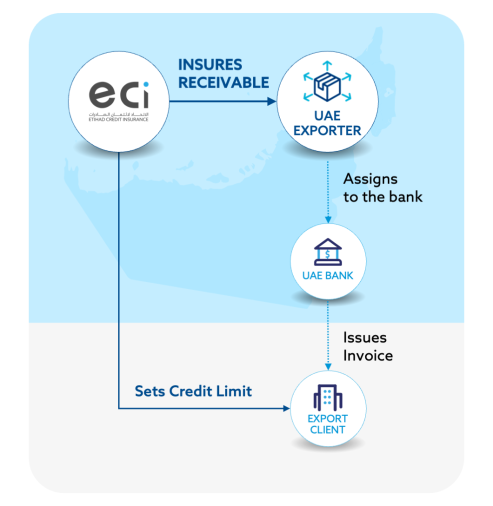

As an exporter, you may discount your receivables to a bank or factor for cash. If there is a payment default on the receivables for any reason, either you or your bank will take the loss. Etihad Credit Insurance (ECI)’s Invoice Discounting Insurance protects you and your bank from loss due to payment default on receivables.

Who is it for?

Whether your business is large or small, at times you may discount your receivables with a factor or bank to better manage your cash flow. ECI’s Invoice Discounting Insurance allows you to manage your credit and offer favorable terms for your receivables to banks or factors.

Key Benefits

Discount your receivables with banks or factors with confidence to enhance your cash flow. ECI protects your discounted receivables against loss from payment default.

When you’re in charge of your credit management, you maintain control over the commercial relationship to better manage small issues that may affect payment. ECI’s Invoice Discounting Insurance keeps you in charge of your credit management instead of banks or factors, while protecting your receivables against loss.

When you insure your receivables with our Invoice Discounting Insurance, your bank moves the credit risk from an unrated company to ECI, a AA- rated institution that allows the bank to reduce the capital it must allocate and enhances the value of your receivables.

With ECI’s Invoice Discounting Insurance, you gain access to our expertise and worldwide resources that can provide background information, payment experience, and financial data on nearly every company and sector. Due to the ECI’s large volumes, we can provide resources and expertise at a fraction of what it would cost the bank.

ECI has a treaty with investment-grade reinsurers that ensures that even large losses are sustainable for ECI, which would not be possible if you were to go it alone. ECI is your partner to help you and your business thrive.

ECI has a global network of specialized debt collection service providers that can collect outstanding receivables anywhere in the world in the case of default of payment. Due to ECI’s large volumes and size, we have negotiated favorable rates that are not possible for banks and other smaller institutions. If there is payment default, the debt collection expenses are added to the claim so the bank will only pay a fraction of the cost.

ECI has the resources and the technology so that the time needed to take a credit limit decision is substantially reduced and a fraction of the time it would take a bank to make a decision.

Product Features at a Glance

How It Works

Step-by-step Guide

The bank agrees on the terms and conditions of the insurance with ECI and signs the policy.

The bank applies for a credit limit on the buyer each time an exporter submits a request to discount the receivable.

ECI assesses each buyer and sets a limit. The limit is the maximum outstanding that is insured.

Once the limit is set, the bank purchases the receivable and knows that it is protected. If the buyer pays on time, there is no need to communicate with ECI. Once invoices are paid, the bank can purchase new receivables from any supplier without notifying ECI and they will be automatically insured up to the set limit.

Remember, this is a simplified guide. Each step can be tailored to suit the unique requirements of your business operations. Your financial security is our priority.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

The bank will follow up on a payment as soon as a receivable is due. In case there is any doubt about the ability to recover the amount due, the bank should inform ECI. The bank will issue formal notice about an overdue payment at the date that is set in the policy schedule.

Once the bank informs ECI about a payment delay, ECI will activate the appropriate debt collection strategy. The bank ensures full cooperation with the exporter to collect all evidence related to evidence of exposure.

Once it is established that the receivable can’t be recovered, the bank will submit a claim along with evidence of loss and compliance with policy conditions. If the bank believes it can manage further recoveries at the end of the waiting period, the claim submission may be postponed. The claim should be submitted with all the appropriate documentation that includes: • evidence that a valid credit limit was in place • invoices and credit terms are in line with the policy • efforts to collect outstanding overdue amount are in line with the credit management policy • adherence to policy compliance An ECI representative can assist with documentation if required.

After you have submitted your claim online, ECI will assess the claim diligently, ensuring transparency and adherence to policy conditions.

Once the claim has been assessed, ECI will send the details of the calculation and ask for approval. Once it has been signed off, the claim payment will be promptly issued to the bank.

If there is still potential for recovery, ECI will work together with the bank and exporter to continue the recovery process even after the payout.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!