Green Working Capital Insurance

Lend with confidence to exporters supporting green investments.

Etihad Credit Insurance (ECI) can support the bank loans you need to finance working capital for your green projects. Our Green Working Capital Insurance protects your loan against payment default, making it easier for you to access the financing you need.

Who is it for?

Export businesses who are engaged in trade, sales, or investments that help mitigate or adapt to climate change and need loans from banks for working capital. ECI’s Green Working Capital Insurance makes it easy for banks to grant working capital loans for your green export business.

ECI’s Green Working Capital Insurance makes it easy for banks to grant working capital loans for your green export business.

Key Benefits

Etihad Credit Insurance (ECI)’s Green Working Capital Insurance reduces the risk of lending to a new client. Providing a working capital loan to your green business becomes an easy and smart decision for your bank.

Etihad Credit Insurance (ECI)’s Green Working Capital Insurance protects your bank in case you default on your loan. The claim is usually paid out before other capital can be activated.

Etihad Credit Insurance (ECI)’s Green Working Capital Insurance acts as additional collateral toward your loan. It is appealing to banks because its value is transparent and can be realized at short notice if needed.

Etihad Credit Insurance (ECI) is an AA- rated institution that allows our solutions to provide excellent support. Banks can significantly reduce the capital they must allocate to an asset.

By providing a loan to your green export business, the bank can report positive initiatives that support Sustainable Developmental Goals (SDGs) in its annual report. ECI’s Green Working Capital Insurance incentivizes your bank to support these initiatives by working with you.

Product Features at a Glance

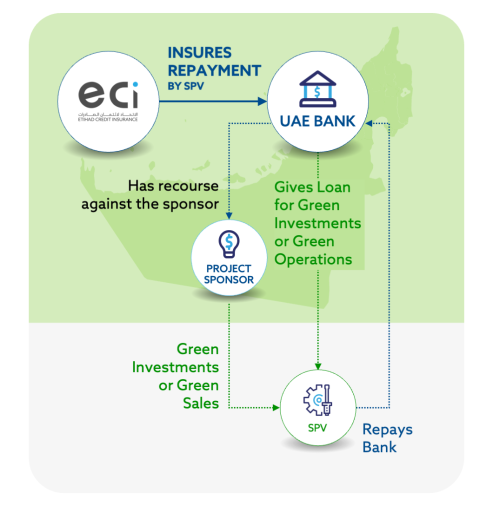

How It Works

Step-by-step Guide

The lending bank will contact ECI with general information about the loan it wants to insure. Loans that have already been disbursed are not eligible for insurance.

Once it is determined that the loan can be insured, ECI will prepare an initial, non-binding quotation. Also included will be an overview of the information needed for ECI to make a thorough assessment to provide a binding proposal. The documentation will provide evidence of the relationship between the purchase funded with the loan and future exports by your company and ECI will also include an assessment in regard to green investments and operations.

Once all the information is provided, ECI will conduct a thorough assessment of your export business and the green transaction. At this stage, the underwriter will work with the bank to discuss details of the cover, policy wording, risks, and mitigation approaches. ECI uses accepted international standards and methods for the assessment of the green contribution of the transaction.

Once internal and external approvals are given for the terms and conditions and the bank signs the policy, the loan can be disbursed. ECI will only be involved in case of payment default or indications of payment problems.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

The bank will notify ECI as soon as it becomes aware that there may be a potential payment problem. Notification is mandatory 30 days after default on the scheduled due date.

ECI will work together with the bank to agree on the best way to manage recovery. Amicable resolution of payment delays, assistance from a specialized agency, or initiating formal litigation may be used to recover payment.

Once it is determined that not all payments can be recovered, the bank can submit a claim along with evidence of loss and policy compliance.

ECI will assess the claim diligently ensuring transparency and adherence to policy. The claim assessment can take up to one month.

After the assessment is complete, ECI will send details of the calculation for approval and sign-off. The claim will be promptly paid out.

If there are still chances of potential recoveries, ECI will work in collaboration with the bank for additional recovery efforts. Any recoveries will be shared between the bank and ECI as per the policy agreement.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!