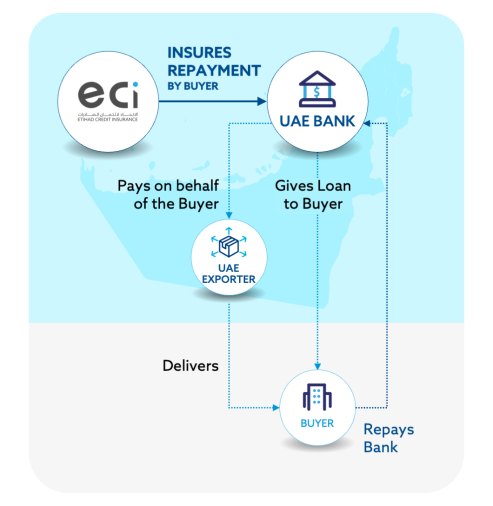

Buyer Credit Insurance

A comprehensive solution for your export business, your buyer, and your bank.

Etihad Credit Insurance (ECI)’s Buyer Credit Insurance offers a full circle solution that enables you to build and grow your export business by offering extended payment terms to your foreign buyers through your bank.

The bank grants a loan to your buyer to ensure that you are paid on time, while offering better terms to your buyer on your export order.

Buyer Credit Insurance protects your bank from payment defaults on a loan given to your foreign buyer to purchase goods from you. This makes lending to your buyers a smart and easy decision for your bank.

Who is it for?

UAE banks that offer loans to foreign buyers for purchases from UAE export businesses.

Key Benefits

Offer a comprehensive solution to your buyers that includes financing for purchases from you. ECI’s Buyer Credit Insurance reduces the risk of non-payment on the loan to your buyer, so your bank will be able to offer competitive rates on the loan. These rates will be lower than what your buyer can access in their domestic market.

According to the contractual agreement, ECI’s Buyer Credit Insurance ensures that the disbursement of the loan is directly to you, not your buyer. This eliminates the potential risks associated with misappropriation of funds, currency conversion, and other delays in payments.

ECI’s Buyers Credit Insurance protects your bank in the case of non-payment on a loan to your buyer. This makes loaning to your buyers less risky for the bank.

By offering lending to your foreign buyers, your bank can expand its reach beyond the UAE. It will gain access to new markets where it will gain a competitive advantage. ECI’s Buyer Credit Insurance supports the bank by reducing the non-payment risks in lending to new overseas clients.

ECI’s Buyer Credit Insurance allows the bank to significantly reduce the amount of capital that it must allocate to the asset. This makes lending to your buyers a smart and easy decision for your bank.

Product Features at a Glance

How It Works

Step-by-step Guide

Buyer’s Credit Insurance requires close collaboration between you, your bank, and ECI.

You and your bank will discuss the potential for cooperation to offer a loan to your buyer and come to an agreement. ECI is not involved in this stage of discussions.

Once it has been established that your bank is able to offer a loan to your buyer, you and the bank will contact ECI to see if we can insure the loan. You and your bank will provide as much information as you can and ECI will share general information about eligibility criteria, the underwriting process, and risks that can be covered.

After ECI establishes that the loan can be insured, we will provide you with a generic non-binding quote. We will also share guidelines on the information required for a thorough assessment, documents needed for review as part of the underwriting process, and how we assess the transaction.

You and your bank will structure the transaction with your foreign buyer and perform the required due diligence. Your bank must also include a thorough assessment of your export business to limit the performance risk (your ability to complete the order and deliver goods to your buyer). The assessment must be complete and thorough. ECI can informally be involved in this discussion.

At this stage, your bank will formally apply for ECI’s Buyer Credit Insurance. The bank will include all the key documents required by ECI in the application, and also include its own internal risk assessments and credit paper.

ECI will review the application and documentation to propose insurance terms and conditions and final policy wording. During this process, ECI will have frequent contact with you and your bank.

Once the policy is mutually agreed upon, it is signed by the bank and the loan agreement can proceed. You and the bank will keep ECI informed on the project’s progress. Depending on the complexity and size of the transaction, ECI may require regular written updates with an overview of disbursements, milestones, or any issues that arise. Loans that have already been signed or disbursed are not eligible for insurance.

Remember, this is a simplified guide, and each step can be tailored to suit the unique requirements of your business operations. Your financial security is our priority.

Get an instant premium estimate

Credit insurance is crucial for safeguarding your business transactions, especially when customers default on payments. Understanding the cost of this protection is vital for strategic planning. ECI offers a quick and easy way to calculate the annual cost of trade credit insurance tailored for your business.

Find your cost estimate quickly and easily here!

The bank will notify ECI as soon as it becomes aware that there may be a potential payment problem. The policy will specify when payment delays must be notified.

ECI will work together with the bank to agree on the best way to manage recovery. Amicable resolution of payment delays, assistance from a specialized agency, or initiating formal litigation may be used to recover payment.

Once it is determined that not all payments can be recovered, the bank can submit a claim along with evidence of loss and policy compliance.

ECI will assess the claim diligently ensuring transparency and adherence to policy. The claim assessment can take up to one month.

After the assessment is complete, ECI will send details of the calculation for approval and sign-off. The claim will be promptly paid out.

If there are still chances of potential recoveries, ECI will work in collaboration with the bank for additional recovery efforts. Any recoveries will be shared between the bank and ECI as per the policy agreement.

Get started with boosting your bottom line and trading with confidence today!

Make a call! or leave a message for call back!